How To Unfreeze Venmo Account – Read Best Guide

How To Unfreeze Venmo Account – The idea of unfreezing a Venmo account could present itself as an impossible task, especially too users who just got their accounts frozen for the first time.

Being a payment platform that allows users to send or receive funds, there are always cases of freezing users’ accounts. When this happens, the functionality of the account is automatically limited.

There are several reasons Venmo freezes accounts, we are going to discuss these reasons. Once you are aware of what made Venmo to freeze your account, it becomes relatively easy to unfreeze it.

For Venmo users asking how to unfreeze Venmo account, please take your time to read this article as we will be revealing the various ways how to unfreeze Venmo account.

- Why Did Venmo Freeze My Account?

- How To Unfreeze Venmo Account

- How To Contact Venmo For Account Unfreezing

- Venmo Account Frozen With Money

- How Do I Know If My Venmo Account Is Frozen?

- Can I Use A Credit Card To Pay Back On Venmo?

- I Am Unable To Pay Back The Full Amount On Venmo

- How To Get Money Out Of Frozen Venmo Account

- How Long Does It Take To Unfreeze Venmo Account?

- Is My Venmo Account Frozen?

- We’re Sorry The Transaction Could Not Be Completed Please Contact The Person You Are Trying To Pay

Why Did Venmo Freeze My Account?

There are typical reasons why online payment platforms like Venmo freeze users’ accounts. In essence, Venmo may freeze your account if you engage in any act that is deemed to have violated their User Agreement.

You Venmo account can also be frozen if you do anything against the widely acceptable credit card policies, this is why you should always be careful with your transactions to avoid your account getting frozen.

Below are the various reasons your Venmo account was frozen.

1. Suspicious Activities

There are several activities that may trigger the Venmo system to freeze your account. As a matter of fact, any activity that seems like compromising the security of an account will be frozen. Read some of the suspicious activities that may get your Venmo account frozen below.

- Entering Incorrect PIN Repeatedly: Once you keep typing in an incorrect PIN, the Venmo system will freeze your account for suspicious activities. You will be required to go through some kind of verification before reigning access to your Venmo account.

- Logging In From A New Computer or Device: This is one of the common reasons Venmo freezes accounts. Once you log in to your account from a different computer or a device, the system may think your account has been compromised.

- Logging In From A Different Location: The Venmo system may suspect a breach of account security if you log in from a different IP or location. Once this suspicion is triggered, it may lead to account being frozen.

2. Violating User Agreement Through Platform Misuse

Venmo is strictly against any user going against the platform’s user agreement by misusing the platform. Engaging in fraudulent activities is one of the surest ways to get your Venmo account frozen.

Sometimes, it may even be that you haven’t really engaged in any fraudulent act, a simple unfamiliar action on the platform could trigger the system to freeze your account. This is not always related to transfer or receiving payment, there are several other actions that may go against Venmo’s user agreement.

3. Not Having Enough Funds

Not having sufficient funds in your Venmo account may get it frozen. This is the most common reason Venmo freezes accounts, once an account doesn’t have enough money to cover a particular transaction, the account will be frozen.

When an account doesn’t have enough funds, Venmo will reverse some payments and freeze the account. One of the best ways to avoid this problem is to ensure you have enough funds in your Venmo account or credit account/bank account, before attempting any payment. Also read: Can I Pay Amazon With Apple Pay?

4. Sharing Account Details

Another reason your Venmo account may get frozen is if you share your Venmo account details with others. This is clearly against the platform’s User Agreement.

In a bid to continually protect users’ accounts and prevent fraud, Venmo demands that users don’t share their account details with others. If they have reasons to carry out transactions with others, they can both have a Venmo shared account.

How To Unfreeze Venmo Account

There are several ways to unfreeze a Venmo account, this depends on why your account was frozen. Let’s carefully explain this, read below.

- Unfreeze For Insufficient Funds: If your account was frozen because of insufficient funds, you need to pay back the amount you are owing by using your debit card or paying with your bank. Once you’ve successfully paid the debt, your account will be reinstated. This is the only method to unfreeze Venmo account for insufficient funds. It doesn’t take long for the account to be reinstated, it takes a few minutes.

- Unfreeze For Suspicious Activities: This is where you’ll need to get in touch with Venmo customer service. If your account was frozen for any reason other than insufficient funds (failed payment), you must contact Venmo for it to be reinstated. Once you’ve contacted Venmo, they will guide you through the process of unfreezing your Venmo account.

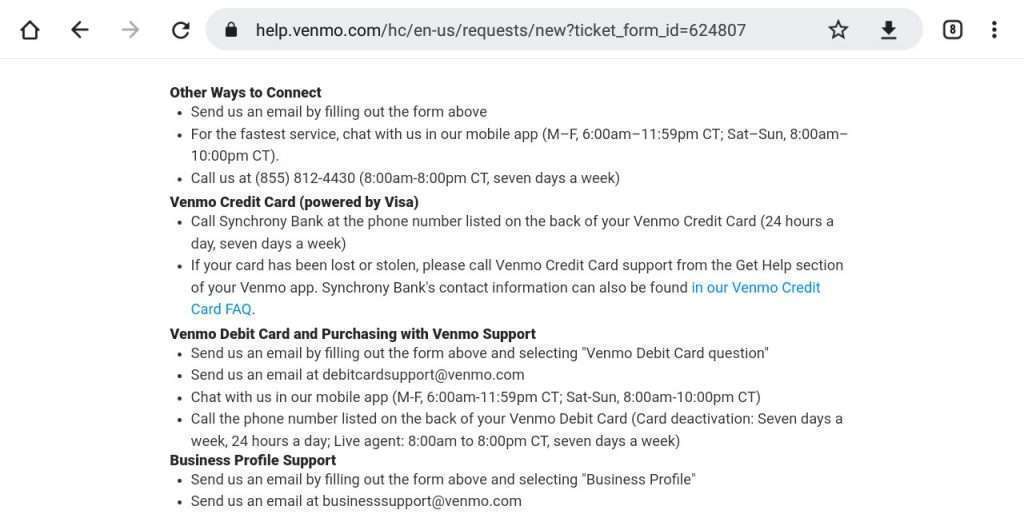

How To Contact Venmo For Account Unfreezing

Anyone whose Venmo account was frozen for reasons other than insufficient funds is required to contact Venmo Customer Support via Webform, mobile app chat, phone, or email. You need to provide your full name, phone number linked with your Venmo account, email address linked with Venmo, provide other information and click on the ‘Submit’ button.

Also, you can easily contact Venmo by replying to the email you received from Venmo concerning the freezing of your account, check your inbox or spam to open the email you received. Can You Use Google Pay On Amazon?

Venmo Account Frozen With Money

If you have enough money on your Venmo account and you still realise it was frozen, it is quite possible that you have violated Venmo User Agreement, or there has been a suspicious activity on your account.

As long as you are sure of having money on your account, you’ll have to contact Venmo to get assistance on reinstating your account. You might want to check your email to really know why your account was frozen.

How Do I Know If My Venmo Account Is Frozen?

The easiest way to know if your Venmo account is frozen is to try making payments, you’ll get a popup message. Secondly, you’ll receive an email from Venmo containing information why your account was frozen and what you should do.

Once you are unable to carry out any transaction on your Venmo account, that is a signal that your account may have been frozen, the best thing at this point is to check your email to see if you’ve received any email from Venmo.

You are generally required to follow the instruction contained in the email to unfreeze your Venmo account. The first step will be to reply the email and explain yourself to the Venmo team, also ensure to attach any required document for verification.

Can I Use A Credit Card To Pay Back On Venmo?

No, Venmo doesn’t allow users to pay back their debts on the platform using credit cards, this is against their policy and will not go through.

You are required to use your debit card to pay your Venmo account negative balance. Users are also allowed to pay back negative balance with a bank account, this will take several days to be completed.

I Am Unable To Pay Back The Full Amount On Venmo

There are instances where users are unable to pay back the full amount on Venmo. In such case, the user can make a partial payment via debit card or with a bank account. To make a partial payment, simply edit the amount by tapping the payment amount and typing in a partial amount.

Note that making payments with a bank account on Venmo will take between 3 – 5 day to reflect on your Venmo account, the estimated date of transaction arrival will be shown if you pay with a bank account.

Lastly, any payment a user receives on their Venmo account will be instantly used to augment the amount owed to Venmo.

How To Get Money Out Of Frozen Venmo Account

You can get money out of your frozen Venmo account by directly contacting Venmo Customer Service and requesting for your account to be reinstated.

It is only when your Venmo account has been reinstated that you can actually get money out. This is because when a Venmo account is frozen, every form of transaction is disabled, this makes it impossible to transfer any amount out or make any payment.

You won’t get any money out of your Venmo account as long as it still remains frozen.

How Long Does It Take To Unfreeze Venmo Account?

Venmo account frozen for insufficient funds will get reinstated once a pay back has been made, account frozen for other reasons may take between 3 – 5 days to be reinstated.

However, you can help speed up the process by chatting with Venmo Customer Support through the mobile app chat feature.

Be aware that Venmo will only review your account issue once you reach out to them either via email, phone call, or mobile app chat feature.

Is My Venmo Account Frozen?

It’s pretty simple, if you are unable to make payments and you receive a pop-up message, your Venmo account has been frozen.

However, account freezing is not always the reason inability to make payment, there could be an issue which can only be explained by your bank. You may have exceeded the permitted number of ACH transfers on your bank account.

To know exactly why if your Venmo account has been frozen, check your email for any mail from Venmo. Users are always notified via email once their accounts get frozen.

We’re Sorry The Transaction Could Not Be Completed Please Contact The Person You Are Trying To Pay

Once you get this notice while trying to make a payment, it is possible that the debit card information you provided is incorrect. Make sure you verify your Venmo debit card details (the numbers, CVV, expiry date).

Also, if you are using an expired or damaged debit card, you’ll likely get the error message, check your debit card to ensure it is not damaged or expired.

Another known reason for the payment error notice is when a customer exceeds their maximum weekly-spending, or have any flagged transaction with bank account. You may need to reach out to your bank to report the issue.

If you have contacted your bank and you continue to face the problem while trying to make a payment, contact Venmo Customer Service.